Right Way is a professional YouTube channel dedicated to Income Tax Return (ITR) filing and Income Tax Notice solutions. This channel is specially created to help salaried individuals, businessmen, professionals, freelancers, and taxpayers understand income tax in a simple and practical way.

On this channel, you will get step-by-step guidance on:

✔️ ITR-1, ITR-2, ITR-3 & ITR-4 filing

✔️ Updated ITR (U/S 139(8A))**

✔️ Income Tax Refund & Rectification

✔️ Income Tax Notices & Replies, including:

• Section 133(6)

• Section 148 / 147 (Reassessment)

• Section 154 (Rectification)

• Section 143(1)(a)

• Section 143(2)

✔️ Practical solutions with real examples

✔️ Latest Income Tax rules, due dates & compliance updates

Shared 2 days ago

742 views

Shared 1 week ago

138 views

Missed Filing Your ITR for AY 2025-26 | How to File ITR 2025-26 | ITR File Online |Income Tax Return

Shared 3 weeks ago

1.6K views

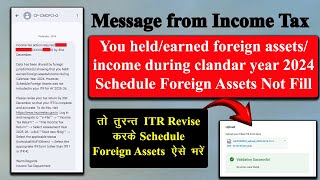

Schedule Foreign Assets was not included in your ITR for AY 2025-26 | Schedule Foreign Assets in ITR

Shared 4 weeks ago

7.4K views

क्या आपको भी Income Tax से Significant Transactions / Significant Mismatch का मेसेज आया है? क्या करे

Shared 1 month ago

2.5K views

Shared 1 month ago

821 views

Shared 1 month ago

158 views

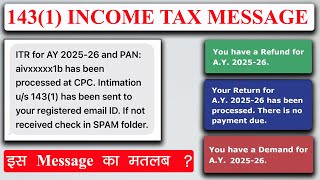

आयकर नोटिस 143(1)(a) | Proposed Adjustments u/s 143(1)(a) of Income Tax Act 1961 | Income Tax Notice

Shared 1 month ago

439 views

Shared 1 month ago

1.2K views

Shared 1 month ago

308 views

3 सालों का ITR कैसे भरे | How To File 3 Years ITR | Updated ITR of Previous Year | ITR-U File Online

Shared 2 months ago

607 views

Shared 3 months ago

549 views

Shared 3 months ago

14K views

Shared 3 months ago

1.3K views

Shared 3 months ago

2.3K views

Shared 3 months ago

2.9K views

💸 How to remove outstanding income tax demand | How to pay income tax demand | How to Remove Inco...

Shared 3 months ago

508 views

Shared 3 months ago

2.7K views

Shared 4 months ago

1.1K views

Shared 4 months ago

334 views

Shared 4 months ago

1.2K views

Short-Term Capital Gains/Long-term capital gains Taxable at The Rate of 20% & 12.5% Validation Error

Shared 4 months ago

6.4K views

How to File Revised ITR | How to File Revised Return for AY 2025-26 | File Revised Income Tax Return

Shared 4 months ago

8K views

Shared 4 months ago

4K views

Shared 4 months ago

3.4K views

Shared 4 months ago

23K views

Shared 4 months ago

3.6K views

Shared 4 months ago

2K views

Shared 5 months ago

1.2K views

🤑 Income Tax Outstanding Tax Demand कैसे हटाये | How to Remove Income Tax Demand | ITR Demand Notice

Shared 5 months ago

25K views

Shared 5 months ago

5K views

Shared 5 months ago

3.4K views

Shared 5 months ago

433 views

Shared 5 months ago

11K views

Shared 5 months ago

1.2K views

Shared 5 months ago

991 views

Shared 5 months ago

9.9K views

ITR 3 Filing in Old Tax Regime 2025-26 | ITR-3 File in Old Tax Regime | How to File ITR 3 in Old Tax

Shared 5 months ago

6.9K views

ITR 2 Filing in Old Tax Regime 2025-26 | How to File ITR 2 in Old Tax Regime | ITR 2 File Old Regime

Shared 5 months ago

2.8K views

ITR-2 कैसे ऑनलाइन भरें | ITR-2 Filing Online 2025-26 | How to File ITR 2 Online 2025-26 | File ITR-2

Shared 5 months ago

3.1K views

Shared 5 months ago

3.6K views

Shared 5 months ago

8.8K views

Shared 6 months ago

10K views

Shared 6 months ago

9.6K views

Shared 6 months ago

12K views

Shared 6 months ago

1.4K views

Shared 6 months ago

2.7K views

Income tax notice u/s 143(2) Online Reply | Income Tax Notice Reply 143(2) & 144B | ITR Notice Reply

Shared 6 months ago

3.2K views

Shared 6 months ago

8K views

Shared 6 months ago

310 views

Shared 6 months ago

12K views

Shared 6 months ago

8.4K views

Shared 6 months ago

5.1K views

Shared 6 months ago

18K views

Shared 6 months ago

711 views

Shared 7 months ago

36K views

Shared 7 months ago

465 views

Shared 7 months ago

1.1K views

ITR 1 File in OLD Tax Regime 2025-26 | ITR Filing Online in Old Tax Regime | Old Tax Regime ITR File

Shared 7 months ago

90K views